It’s been said before and it’s true today, “an ounce of prevention is worth a pound of cure!” So it goes with rebuilding our lives after a disaster, like a hurricane. If you think there will be funds available from the Federal Government to rebuild your home, business and jobs … think again.

Since 2003, the federal disaster-relief fund has been depleted six times stopping thousands of reconstruction projects. In late August, FEMA’s cash supply fell to such a low level that the agency suspended $550 million in funding for thousands of long term recovery projects nationwide. Those projects included rebuilding parts of Katrina-ravaged Louisiana and in areas of Miami still recovering from a Nov 2000 storm. We can expect that FEMA will make every effort to tighten up the criteria for qualifying for disaster aid. In other words, expect money that is not available to be even harder to get.

Are you willing to put your life on hold for a promise that the Federal Government will help you out?

Why? With proper planning and a visit with your insurance agent you can insure yourself against loss or at the very minimum, keep the recovery expense to a reasonable and predictable amount.

Here are questions you should be asking your agent:

1. Does my homeowners/renter’s policy include windstorm damage? Earthquake damage? Replacement cost coverage on the building and contents? Cost to bring my home up to the current building codes? How about the expense to live elsewhere while my house is being rebuilt?

2. Are the limits of my coverage equal to the replacement cost of my home? How can I reduce the cost of insurance? Will a higher deductible be acceptable?

3. If my policy does not include windstorm coverage, what will it cost to buy coverage?

4. What is the cost of flood insurance?

5. What is the financial standing of my insurance carrier? Is my company an admitted company in SC? What does that mean and how does it affect me and my ability to collect under my policy?

6. Who do I report claims to?

7. What coverages do I need for high value personal items like jewelry, collectables, art and antiques. What about my boat? My car? My Life? My health? Disability?

Yes, premiums are high in coastal communities but so are the risks and the cost of recovery. The greatest catastrophic exposure we have is to windstorm followed by flooding. These are huge weather events not to mention the effect of +20 inches of rain. It may be days after the storm before all the rain falling in the Upper State to reaches your backyard.

DO NOT RELY ON THE FEDERAL GOVERNMENT TO BAIL YOU OUT! Invest in a meaningful visit with your insurance agent and don’t be afraid to ask the tough questions.

Latest from Uncategorized

The “burning of the green” at Habersham, captured here by Ron Callari, refers to an annual

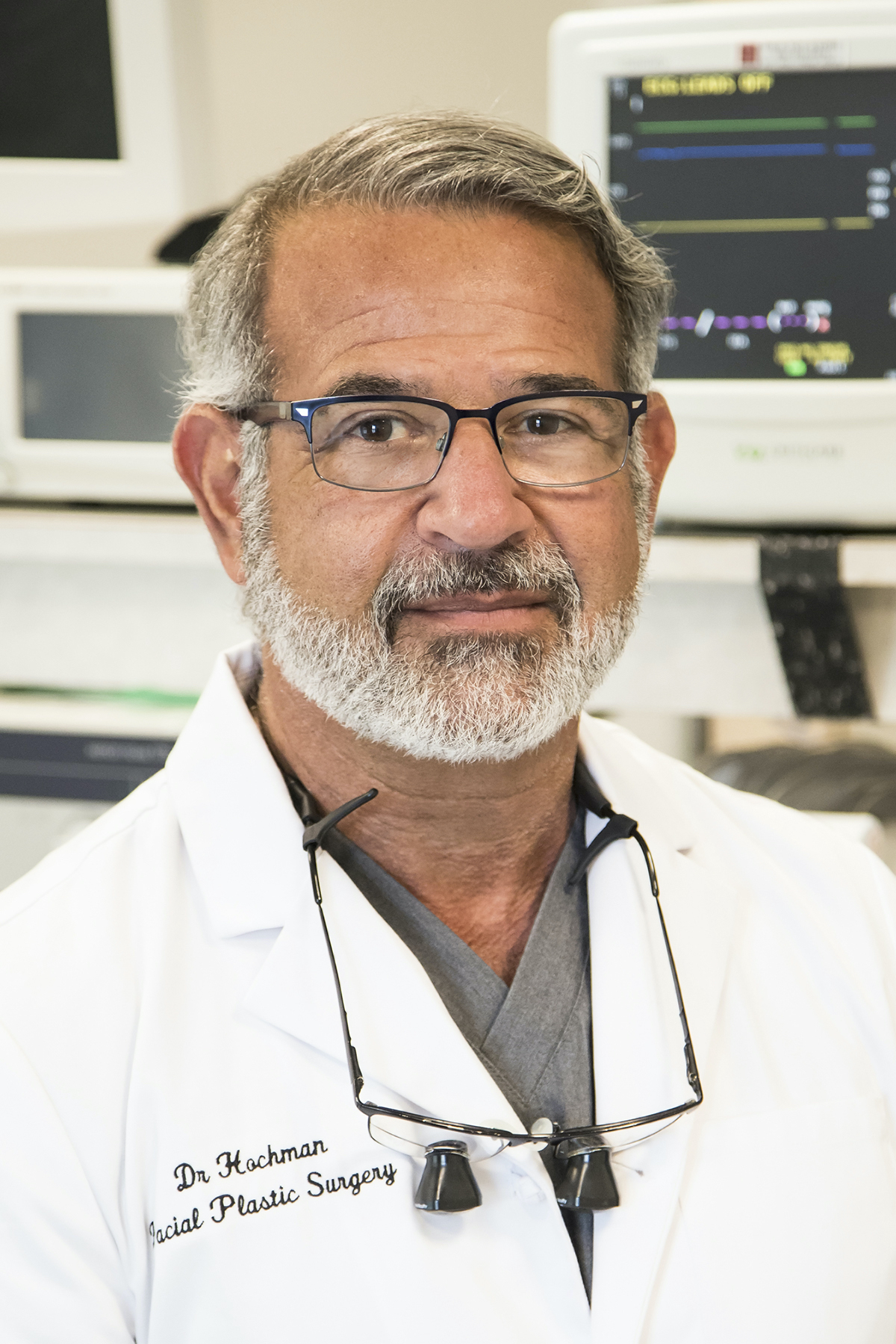

By Dr. Marcelo Hochman The 2026 calendar year marks the final year before the full effect

By Delayna Earley The Island News A Beaufort County woman injured during October’s mass shooting at