By Hall Sumner

Greg McKeown’s “The Disciplined Pursuit of Less” in the Harvard Business Review is thought-provoking on so many levels. The article must be read in full to really appreciate his point, but the concluding paragraph is a nice summary:

“If success is a catalyst for failure because it leads to the “undisciplined pursuit of more,” then one simple antidote is the disciplined pursuit of less. Not just haphazardly saying no, but purposefully, deliberately, and strategically eliminating the nonessentials. Not just once a year as part of a planning meeting, but constantly reducing, focusing and simplifying. Not just getting rid of the obvious time wasters, but being willing to cut out really terrific opportunities as well. Few appear to have the courage to live this principle, which may be why it differentiates successful people and organizations from the very successful ones.”

While this principle can be applied to nearly every aspect of our lives, it has a clear application to portfolio construction and financial planning. Some variation of the following story is common: An individual succeeds at earning a high income. Either on his own or with the help of a financial advisor, investments are made. The years pass. Additional investments are made. Money with a money manager here, a group of mutual funds there, positions in some individual stocks here… Pretty soon, this person has become a collectoras opposed to an investor. In the collector scenario, it is just possible that everything works out okay. Perhaps there will be big enough winners in the mix to cover any losers. However, it is possible that some of those investments were ill-conceived and will be a major drag on the overall portfolio over time — all while not being carefully watched.

Contrast that approach with the investor who purposely employs an asset allocation with more limited, but thoroughly researched investment strategies (we have written many times before about the rationale for mixing relative strength, value, and low volatility strategies). It is quite possible that this more disciplined investor will be able to earn greater returns and amass greater wealth over time than the collector and still retain the benefits of diversification.

No realistic person has the expectation of a perpetual state of success. Setbacks are just part of life and investing. However, the investor who purposefully, deliberately, and strategically eliminates the nonessentials and focuses their resources on the areas where they are likely to achieve the greatest rewards has taken a big step towards putting the odds in their favor.

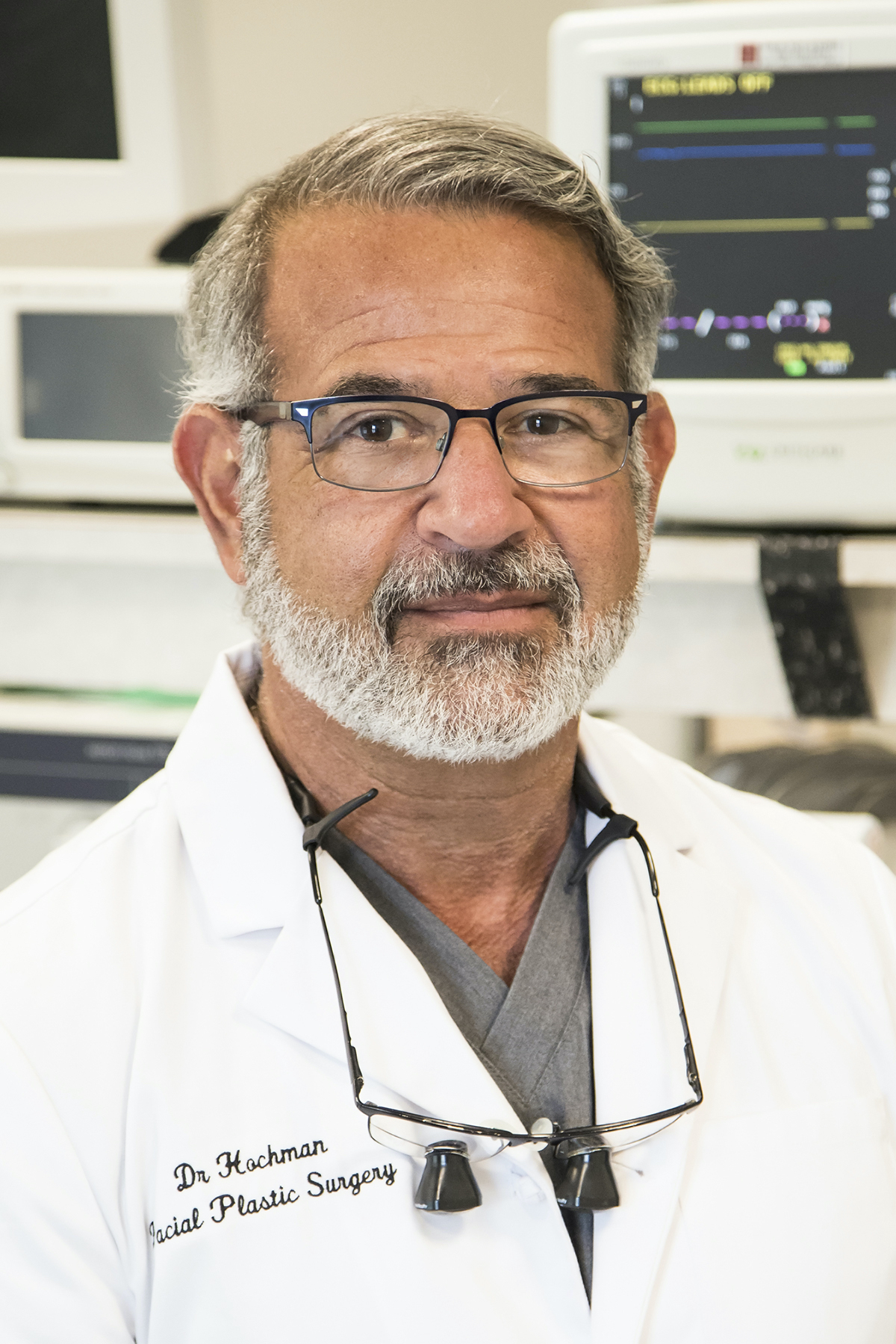

This article was written by Dorsey, Wright and Associates, Inc., and provided to you by Wells Fargo Advisors and Hall Sumner, CFP®, Financial Advisor in Beaufort, SC, 211 Scott Street, (843) 524-1114. The information contained herein has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any recommendation (express or implied) or information in this material without obtaining specific advice from their financial advisors and should not rely on information herein as the primary basis for their investment decisions. Information contained herein is based on data obtained from recognized statistical services, issuer reports or communications, or other sources believed to be reliable (“information providers”). However, such information has not been verified by Dorsey, Wright & Associates, LLC (DWA) or the information provider and DWA and the information providers make no representations or warranties or take any responsibility as to the accuracy or completeness of any recommendation or information contained herein. DWA and the information provider accept no liability to the recipient whatsoever whether in contract, in tort, for negligence, or otherwise for any direct, indirect, consequential, or special loss of any kind arising out of the use of this document or its contents or of the recipient relying on any such recommendation or information (except insofar as any statutory liability cannot be excluded). Any statements nonfactual in nature constitute only current opinions, which are subject to change without notice. Neither the information nor any opinion expressed shall constitute an offer to sell or a solicitation or an offer to buy any securities, commodities or exchange traded products. This document does not purport to be complete description of the securities or commodities, markets or developments to which reference is made.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. You should consider this strategy’s investment objectives, risks, charges and expenses before investing. The examples and information presented do not take into consideration commissions, tax implications, or other transaction costs.

Diversification does not guarantee profit or protect against loss in declining markets. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. Wells Fargo Advisors, LLC did not assist in the preparation of this report, and its accuracy and completeness are not guaranteed. The opinions expressed in this report are those of the author(s) and are not necessarily those of Wells Fargo Advisors or its affiliates. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Wells Fargo Advisors is the trade name used by two separate registered broker-dealers: Wells Fargo Advisors, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, non-bank affiliates of Wells Fargo & Company. Wells Fargo Advisors, LLC, Member SIPC, is a registered broker-dealer and a separate non-bank affiliate of Wells Fargo & Company.