By State Farm™

A college education is a gift that most parents would love to give their children. But with higher education becoming pricier each year, it’s important to use time to your advantage and to save early.

College education expenses grew an average of 5.6 percent a year beyond general inflation from the 2010-2011 academic year to the 2011-2012 academic year, according to the College Board. If costs continue to rise at that pace, the College Board estimates that today’s high school students could expect to pay close to $100,000 to attend a public, in-state university for four years, and more than twice that for a private institution.

Many families don’t believe they can save enough to pay the continually rising college costs, especially given other important short- and long-term goals in their financial plan.

Start Saving Now: The sooner you begin saving for your child’s education, the better: A head start will give your investment more time to grow, as well as more time to ride the market’s ups and downs.

Many students do receive financial aid; for the 2001-2012 academic year, more than $178 billion in financial aid was awarded to undergraduate students, according to the College Board. Still, most colleges expect parents and students to contribute their share. In addition, typical financial aid packages also rely on loans.

Thankfully, the federal and state governments have made saving for college easier with tax-favored education funding options. But how do you decide which vehicle is right for you?

Options For College Funding: To determine how to best save for your child’s college education, you may want to start by comparing the following popular investment alternatives:

• 529 Plans: Section 529 Plans are higher education saving and pre-paid tuition plans established under Section 529(b) of the Internal Revenue Code as ?qualified tuition programs. There are two types: the 529 college savings plan and the 529 prepaid tuition plan.

The 529 college savings plan is an investment program that allows you or other family members and friends to invest in an account designated for qualified higher education expenses. Contributions may be used at any eligible U.S. higher-education institution, as well as some abroad.

With a 529 prepaid tuition plan, you essentially buy all or part of a public in-state education at present-day prices. The program will then pay for future college tuition at any of your state’s eligible colleges or universities (or a payment to private and out-of-state institutions). Most 529 prepaid tuition plans have residency requirements and are sponsored by state governments, which then guarantee the investments.

• Coverdell Education Savings Account: The Coverdell Education Savings Account (ESA) is a trust or custodial account that provides you with a tax-advantaged method to save up to $2,000 per year for your child’s education. Included is elementary and secondary education as well as post-secondary education, such as college, graduate school or vocational school. An ESA may be established for the benefit of any child under age 18, with contributions beginning any time after birth and continuing until the 18th birthday.

• Custodial Account: You can establish an account for your child under the Uniform Gift to Minors Act or the Uniform Transfer to Minors Act, depending on which law applies in your state. The account allows you to make gifts to your child without setting up a trust. The contributions made to an account of this type are considered irrevocable gifts to the minor in whose name the account is registered.

Latest from Uncategorized

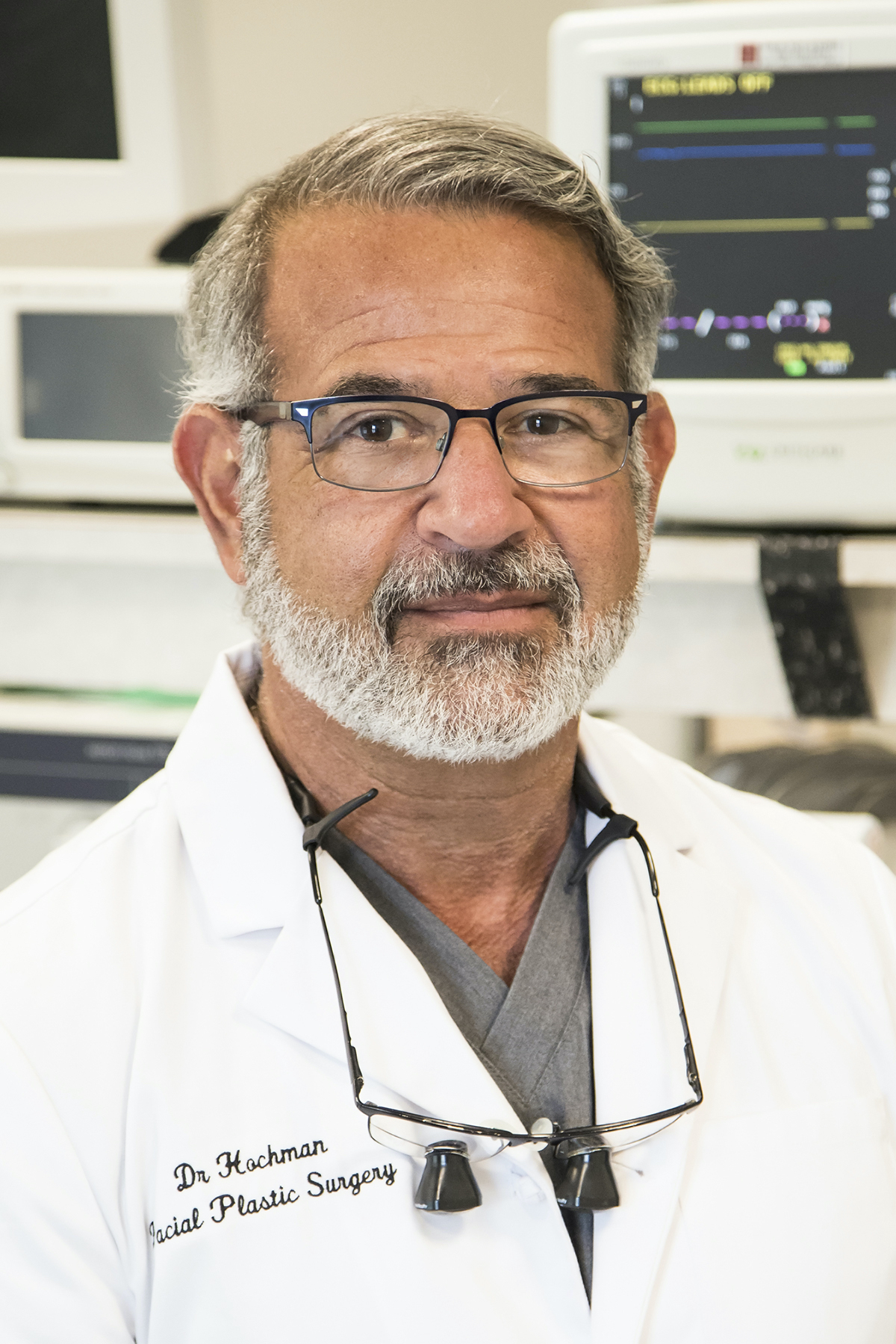

By Dr. Marcelo Hochman The 2026 calendar year marks the final year before the full effect

By Delayna Earley The Island News A Beaufort County woman injured during October’s mass shooting at

From staff reports The City of Beaufort has announced the selection of Eric Claussen as its