As hurricane season is just about to get underway, the SC Wind and Hail Underwriting Association (The Wind Pool) is raising the cost of wind and hail insurance by an average of 10% for those property owners who can’t get coverage through private insurance companies.

The Wind Pool is the State run insurer of last resort for properties that are located along the coast. The premium increase has been approved by the SC Department of Insurance and will take effect for policies renewing as of September 1. Properties located in Zone 1 primarily on the barrier islands will see a larger increase than those located in Zone 2 (Lady’s Island is rated as zone 2).

The last premium increase came in 2009 and was just 1.6%.

“We had actually asked for more, 18.9 percent,” said Smitty Harrison, executive director of the S.C. Wind and Hail Underwriting Association.

Harrison said the wind pool needs more money because the cost of reinsurance has increased. Reinsurance is insurance that the wind pool buys, worth about $1.3 billion, so that it would have enough money to cover claims in a catastrophe.

“When the major disaster occurs, we’ll have the money to pay for that,” Harrison said.

What can consumers do about this?

- Look around to see if another insurance company will include the wind coverage within the base homeowner policy. The insurance market is now more competitive than it has been over the last several years and many companies are willing to include the wind and hail coverage within their policies.

- Review your deductibles. The wind and hail deductible is usually stated as a percentage of the property’s limit. Deductibles typically range from 2% to 10%. Premium credits are usually significant if you are willing to share more of the risk and increase your deductible.

- Consider the accuracy of your coverage limits. The replacement cost must contemplate the actual cost to rebuild your property if a major disaster were to strike. Also consider the amount of coverage on your contents, which is the value of the items you own located within the property.

- Finally, be prepared! Have an emergency plan. Do everything you can to mitigate the cost of a major claim and protect your property.

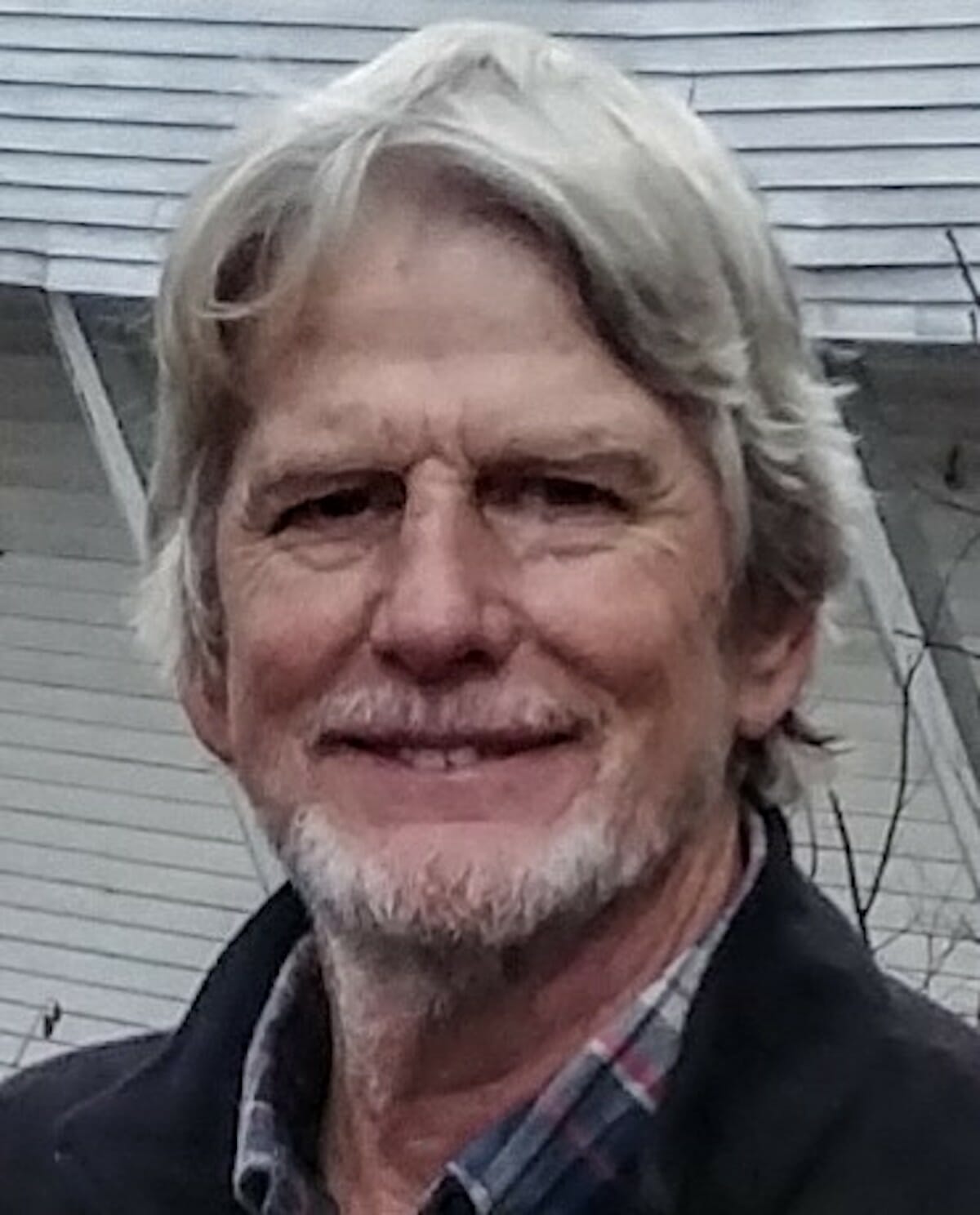

Jeff Althoff, Vice President, Lowcountry Insurance Services