The 13th annual South Carolina Sales Tax Holiday, which was implemented in 2000, will begin Friday, August 3 at 12:01 a.m. and tax-exempt purchases can be made through Sunday, August 5 at midnight. While providing taxpayers with an exemption on the 6% statewide sales tax as well as any applicable local taxes, the tax-free weekend also benefits in-state businesses by urging taxpayers to do their back-to-school shopping in South Carolina.

During this time, taxes will not be imposed on clothing, shoes, school supplies, book bags, computers, printers, bedspreads and linens, and more. Nonexempt items during the weekend include the sales of jewelry, cosmetics, eyewear, furniture, or items placed on layaway. Portable devices whose function is primarily used for telephone calls, listening or downloading music, watching videos, or reading books, are not exempt during the tax-free weekend.

During this time, taxes will not be imposed on clothing, shoes, school supplies, book bags, computers, printers, bedspreads and linens, and more. Nonexempt items during the weekend include the sales of jewelry, cosmetics, eyewear, furniture, or items placed on layaway. Portable devices whose function is primarily used for telephone calls, listening or downloading music, watching videos, or reading books, are not exempt during the tax-free weekend.

The popularity of the tax-free weekend has made it the third busiest shopping period of the year, surpassed only by the weekends after Thanksgiving and before Christmas, as South Carolina shoppers save approximately $3 million during the tax-free weekend.

For more information about this year’s Sales Tax Holiday, including an example list of exempt and nonexempt items as well as a listing of frequently asked questions, visit the SC Department of Revenue website, www.sctax.org.

Latest from Community

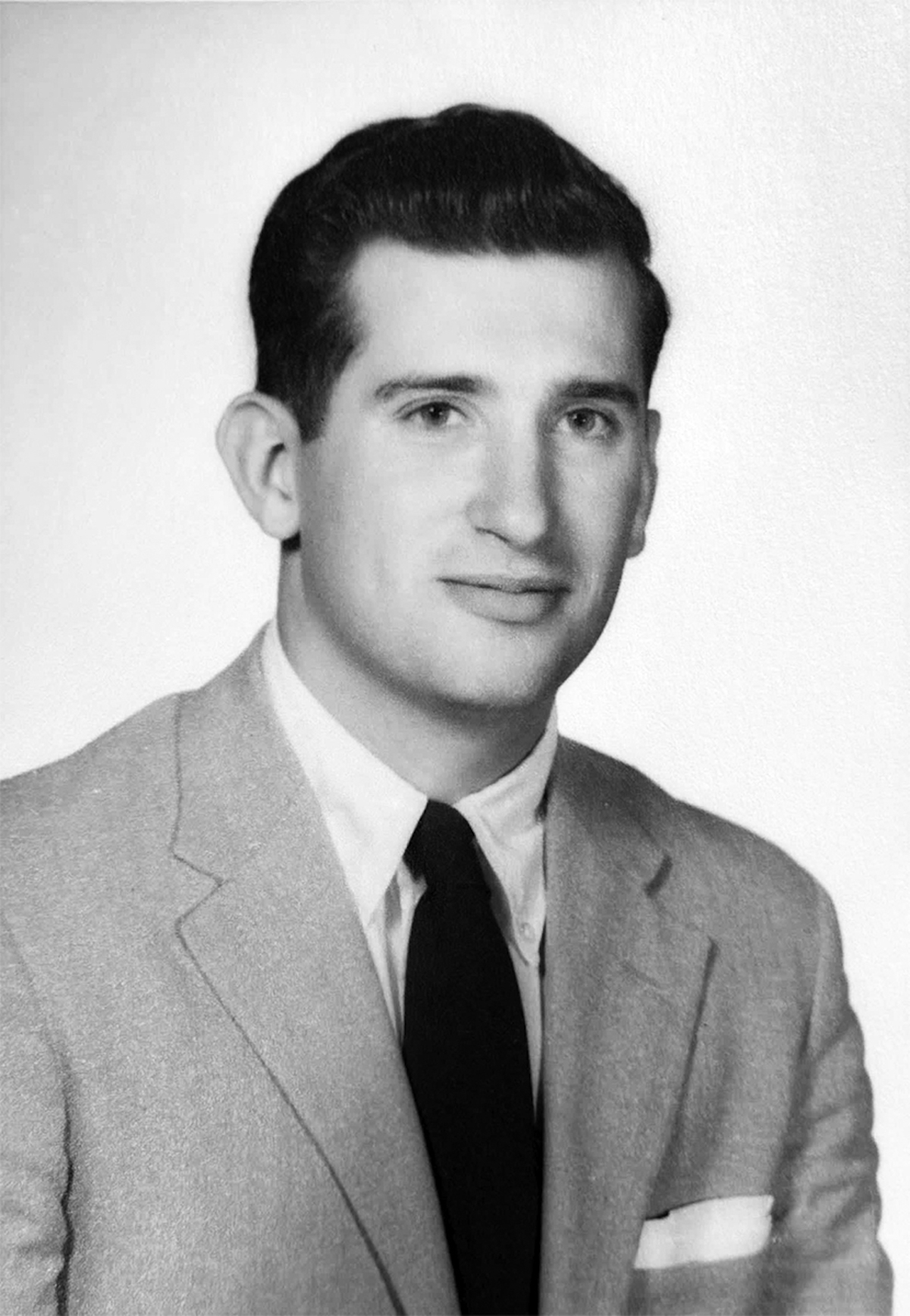

December 26, 1939 – May 4, 2025Beaufort Robert Leo Kreul passed away at home in Beaufort

The Beaufort Memorial Collins Birthing Center saw four sweet new arrivals on Independence Day, ringing in

February 4, 1959 – June 12, 2025 Savannah, Ga.David James Bussing, 66, of Savannah, passed away

September 7, 1938 – May 12, 2025 James L. Smithson (Jimmie), 86 passed away unexpectedly on