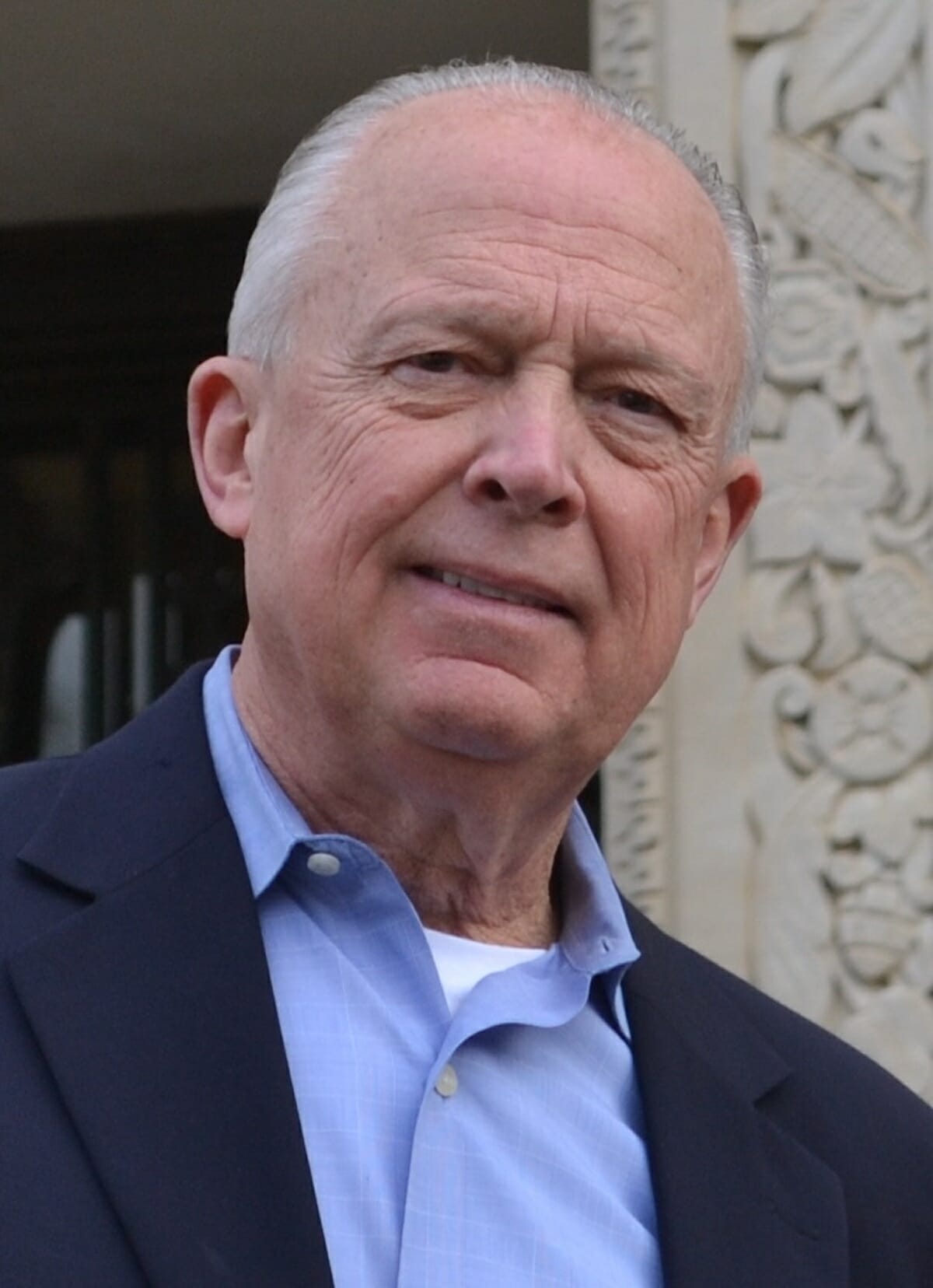

By Richard Eckstrom

It definitely doesn’t get the attention it deserves, but it’s among the most severe financial problems facing South Carolina today: The state retiree pension plan is underfunded by a whopping $25 billion. That means, as things currently stand, the state is obligated to eventually pay out $25 billion more in pension benefits than the plan will have on hand to make those payments.

Twenty-five billion dollars is a whole lot of money – nearly two and one-half times the state’s general operating budget – and there are no painless options for making up a shortfall of this size.

Elsewhere in the country, years of neglecting pension plan shortfalls has necessitated drastic steps: Sharp cuts in services, steep tax hikes, defaults on benefit payments to retirees, or any combination of these. A city in Illinois laid off 40 police officers and firefighters. A school board in Colorado shuttered an elementary school. A school board in Oregon shortened the school year by five days and laid off employees. Property taxes shot up 35 percent in one city, and they increased $298 annually in another.

These examples should be a wake-up call to state lawmakers. Paying down our pension plan shortfall ought to be at the top of their priorities.

As is the case with so many of our problems, South Carolina’s pension woes are rooted in politics.

There’s always been tremendous political pressure to keep contribution rates – the percentage of each employee’s salary that goes into the pension fund, and the even greater percentage that taxpayers kick in – as low as possible. As a result, contribution rates have historically been inadequate to cover these annually-mounting promised benefits.

Officials have often gotten away with this by using overly optimistic projections of future investment returns on the contributions being deposited into the pension plan. These projections have masked growing shortfalls by making it appear as if the plan will accumulate more money than it actually will. (Using artificially high projections for investment earnings has also created a funding crisis for other pension plans nationwide.)

A 2017 law in South Carolina increased contribution rates and made other structural changes to the plan – including reducing the assumed rate of earnings on investments – but those changes fell far short of what’s needed.

To be sure, what’s needed is more than money. Serious reforms are necessary to make the plan healthy over the long term. Short of that, though, we should be doing what we can now to close the $25 billion gap. Time isn’t on our side. Putting off dealing with pension problems only makes them worse.

Last month, the state got some welcome financial news from surging revenue collections, which led state economists to significantly increase their estimates of the tax and other revenue to be collected by the state this year and the next. In response, lawmakers are scrambling for ways to spend the surprise windfall. I’d offer that state government has no need more urgent than to begin paying off its unfunded pension promises, and there’s no wiser use of the surprise windfall.

The promised pension benefits are going to have to be paid, and every bit of the shortfall we pay down now will help alleviate some of the inevitable financial pain that lies ahead.

Richard Eckstrom is a CPA and the state Comptroller. He’s president of the National Association of State Auditors, Comptrollers, and Treasurers.