On the first Monday in October 2014, Michelle Lewis’ lifelong home in Beaufort’s Historic District was sold at the Beaufort County Delinquent Tax Sale because she couldn’t pay the $1,399.77 in delinquent taxes, penalties, and fees.

Disabled by knee surgery and her income tax refund held up because of faulty paperwork, Lewis, the mother of seven and grandmother of 19, was terrified that she’d lose the comfortable family home that her late parents had left her. When her redemption costs rose to $5,598.11 from a tax bill that had originally been just $1,108.50, Lewis was desperately seeking–but not finding any financial assistance.

But a tearful phone call to the non-profit Pan-African Family Empowerment & Land Preservation Network, Inc. in Beaufort got Lewis the money she needed to avoid becoming homeless. And she’ll finally have peace of mind weeks ahead of the Oct. 7, 2015 deadline for redeeming property sold in 2014.

On Monday, July 13, the PAFEN will pay $5,523.11 of her property redemption costs. And Lewis will pay just $300 with money that she borrowed from friends and relatives. It’ll be the PAFEN’s biggest redemption to date, and what Lewis is calling “my blessing.”

“I thank God that my cousin saw that flyer in Piggly Wiggly,” says Lewis, whose home redemption by the PAFEN includes a $2,799.54 interest payment to the winning bidder on her home.

“This sure is a blessing for me. I was already planning to pack up and leave Beaufort. Trying to stay here without my house would have been too hard for me to handle,” says the former home health care worker.

Lewis’ home and land, which is just around the corner from the City of Beaufort’s tennis courts, has a market value of $212,500, according to Beaufort County tax records.

And because the winning bid on her property was $65,000 it wouldn’t take long for the 1% per monthly interest due to the winning bidder to balloon her original tax bill. But thankfully the bidder interest was capped at $2,799.54.

Because Beaufort County allows bidders to earn 1% interest per month on their winning bids, each year its Delinquent Tax Sale attracts a growing number of investors and hedge fund managers who make huge profits that far exceed what they’d earn in interest from U.S. banks. But their big bids often lead to heartache for low-income property owners.

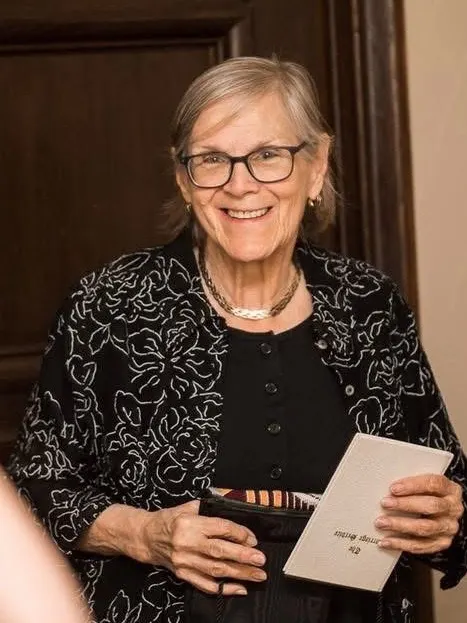

“Michelle Lewis’ redemption costs are a perfect example of why land rich, but cash poor Gullah/Geechee families are losing their homes and land. The interest, penalties and fees are squeezing them out of their property,” says PAFEN Founder, President & CEO Theresa White, a former journalist and congressional aide.

Mobile home owners have it enough worse, says White, because they have to pay monthly rent to the winning bidder to remain in their homes. That’s in addition to the interest, fees, and penalties needed to redeem them.

“How can they expect people who can’t afford to pay their taxes in the first place to come up with so much extra money to redeem it?” White asks.

The PAFEN was founded, among other things, to help create solutions that will prevent Gullah-Geechee families and other people of African descent from losing their homes and land, White explained.

In March 2015, the 501c3 tax-exempt PAFEN launched an online $5-million “Help Save Gullah/Geechee Land” campaign on GoFundMe.com, which has collected $8,000 in donations through July 9.

Donations collected during the “Help Save Gullah/Geechee Land” campaign will be used in three ways, White says: To redeem property sold at delinquent tax sales; to pay taxes to prevent properties from being sold at tax sales; and one-time tax grants to allow Gullah/Geechee families to transition to the Installment Payment Program that breaks taxes into five equal advance payments on the upcoming year’s taxes.

Through a newly-formed partnership with the Beaufort County Black Chamber of Commerce, PAFEN clients who want to become eligible to enter its Taxpayer Lottery to receive a one-time grant to pay their taxes for a year, can take the required budget classes at the Black Chamber’s office. The BCBCC is located at 801 Bladen St. in Beaufort, and can be contacted at 843-986-1102.