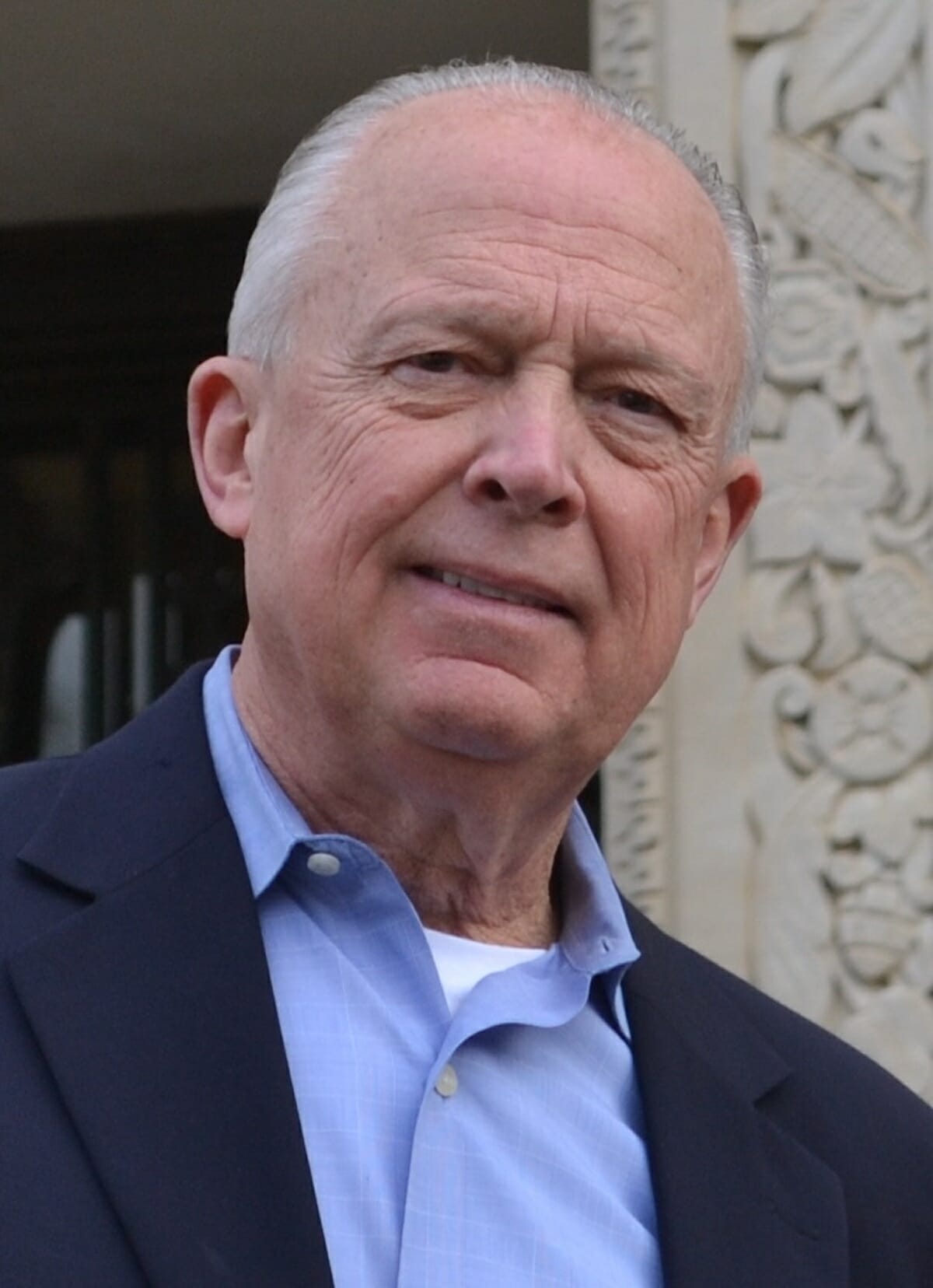

By Richard Eckstrom

After four decades as barely a blip on the radar, inflation once again rears its ugly head.

Just look around. Things are getting sharply more expensive. Gas and food prices are way up. Used cars and building materials cost more. The average cost of goods and services has risen 5.3 percent during the past year – well above the 2 percent deemed healthy by economists.

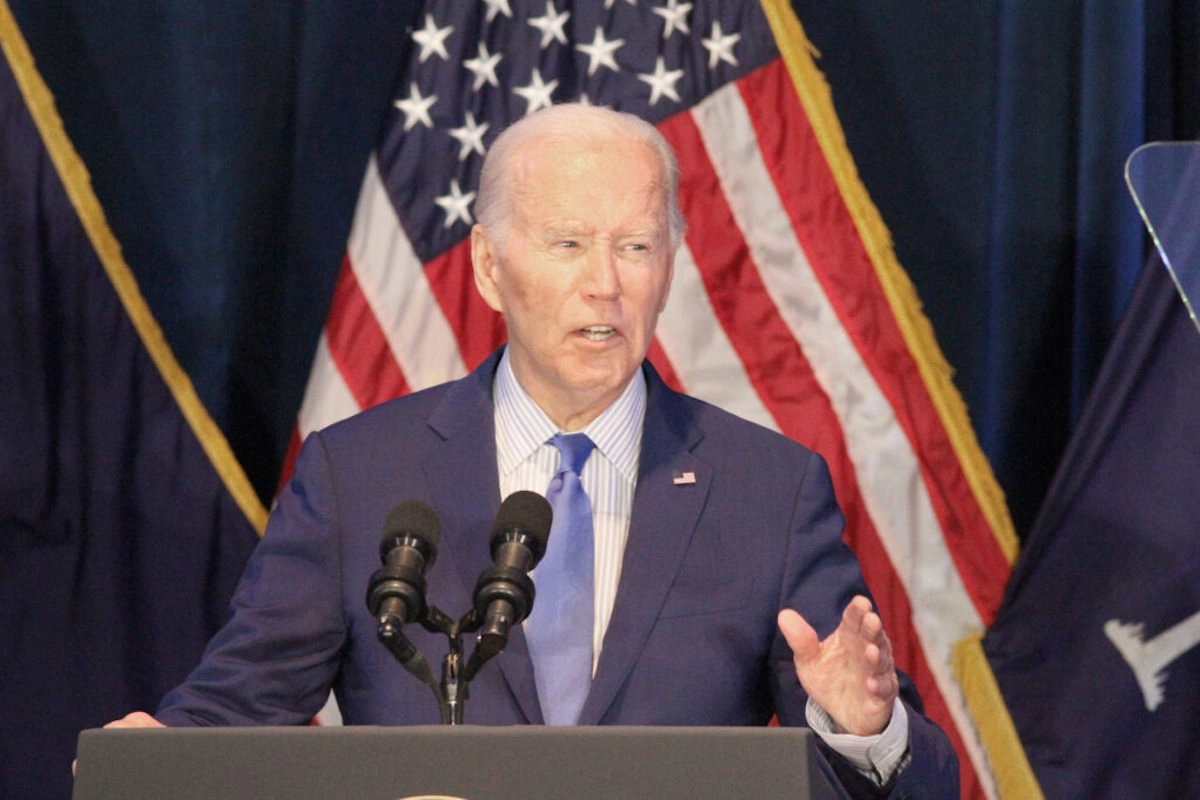

White House officials are eager to downplay the inflation spike. It’s nothing to be alarmed about, they say, just a temporary headache caused by pandemic-related shutdowns.

Of course, it’s hard to know how much the White House believes its own spin. The surge in consumer prices comes at a moment the president is pressing his case for a sprawling, $3.5 trillion social spending bill. Admitting there’s inflation would jeopardize that bill, because its eye-popping price tag would likely further fuel inflation. That’s not something people will easily stomach if they’re already nervous about fast-rising living costs.

Much rides on convincing people the high prices we’re seeing won’t stick around.

The spiking inflation rate comes amid a record-shattering government spending binge, much of it billed as “stimulus” to counter the impact of pandemic-related shutdowns. Meanwhile, the shutdowns disrupted supply chains while increased unemployment benefits helped create labor shortages.

That’s the certain recipe for inflation: increasing the money circulating in an economy (increasing demand) versus the amount of goods and services available for purchase (reducing supply). When demand for goods and services exceeds their supply, prices go up. So, that flood of federal dollars we’ve recently seen is a reason we’re seeing higher grocery bills today. The question is, how long will rising prices continue, and how bad will they get?

Certainly, downplaying the inflation threat is the politically convenient move.

When sluggish growth is the main threat to the economy, Washington’s standard remedy is a spending spree. But when the predominant threat is inflation, a spending spree drives up inflation even more. That’s when it’s time for Washington to cut up its credit cards. That’s not what the White House wants to hear as it’s pushing another massive spending bill.

The White House says the current bout of inflation is driven by a couple of factors temporarily causing demand to outpace supply: people spending their savings because businesses and factories have re-opened, and lingering labor shortages and bottlenecks caused by the shutdowns. Officials insist inflation will be short-lived.

Skepticism is warranted, however. There’s no end in sight for the supply chain bottlenecks, and they may further worsen. And while it’s likely that some of the factors at work here are temporary, there are some that aren’t – such as increased home prices, gasoline, groceries, and of course, federal spending.

Even some economists on the left have sounded the alarm about the president’s free-spending agenda. They include Larry Summers, a former top economist for presidents Clinton and Obama, who clearly struck a nerve earlier this year in warning that inflation could remain for a while. He suggests tapping the brakes on spending.

A lawmaker from the president’s party has advocated a “pause” on the impending spending bill until a clearer inflation picture emerges. That’s good advice. We mustn’t tempt fate by rushing through a spending bill that could worsen inflation’s sting.

Inflation eats away at our purchasing power and erodes our standard of living. It’s a hidden tax hike. And politicians who fancy themselves champions of lower-income Americans should keep in mind that inflation hurts the little guy the most. For people struggling to get by, necessities become even less affordable.

There’s no evidence to justify dismissing the inflation threat out of hand. To ignore it risks increasing the intensity and duration of the pain ahead. And let’s just say the White House’s recent track record doesn’t inspire confidence in its ability to read warning signs, no matter how clear.

Pumping the brakes on government spending is the only wise course of action.

Richard Eckstrom is a CPA and the state Comptroller. He’s president of the National Association of State Auditors, Comptrollers, and Treasurers.