By Bill Rauch

Last week Congress quietly kicked the National Flood Insurance Program (NFIP) can down the road three months, to just past the November elections. The program — which for most of us who live near the Carolina coast is the underwriter of our flood insurance — has been kicked around a good bit in recent years.

It’s got some dings in it for sure.

Seeking to cover the claims arising from 2017’s Hurricanes Harvey, Irma and Maria, for example, the NFIP had to be bailed out by Congress (President Trump signed the bill) to the tune of the $16 billion it lent the program last year. But that big check notwithstanding, the program is now in hock another $20.5 billion for more recent claims.

Up until Hurricane Katrina in 2005 the NFIP program was largely self-sustaining — which means aside from a few glitches the premiums generally covered the claims — but as the seas have risen since then Congress has repeatedly had to step in with subsidies in the form of forgiven debts to prop up the program.

Congress and presidents clearly bridle at writing these big checks. But what to do?

Premiums went up on average by about 8 percent across the board this year. That’s a big pill, but it’s well under the 18 percent per year residential cap Congress imposed on the NFIP in 2012, after the program took its last run at becoming self-sustaining.

Recently NFIP officials have begun saying in 2019 they will roll out a new path forward for the program to once again become self-sustaining (they say using “risk-based pricing”) in 2020. They have kept the details of their plan to themselves so far and it is likely their silence will continue through the November midterm elections.

But here are a couple of hints.

When he signed the $16 billion check last November, President Trump suggested what he called some “common-sense steps” that NFIP should take to make itself again self-sufficient. The president’s suggestions were: large scale buyouts, stiffer disaster-resistant building codes, requiring that existing buildings be elevated, and financial rewards to communities that devise and implement new and unconventional approaches.

Here’s another hint. A year ago Brock Long, the president’s appointee who heads the Federal Emergency Management Agency (FEMA), suggested regulatory change that would shift the responsibility for preparing for and cleaning up after disasters to states, counties, cities, and homeowners. “I don’t think the taxpayers should reward risk going forward,” he said then.

This approach would be consistent with the president’s approach to highway-building: Give the states some money and most of the responsibility. But Congress has so far declined to go along with him.

The executive branch’s NFIP handwriting is pretty clearly on the wall, but will Congress go along?

That, it strikes me, is an excellent question to put before Katie Arrington and Joe Cunningham, who are currently running to fill Congressman Mark Sanford’s seat.

Accordingly, I took the liberty of asking both campaigns the following question: “Do you agree or disagree that the NFIP (federal flood insurance program) be brought to self-sustainability by any, all, or none of the following means?

- More aggressive ‘risk-based’ premium pricing.

- Large-scale buyouts.

- Stiffer disaster-resistant building codes.

- Requiring that existing buildings be elevated.

- Financial rewards to communities that devise and implement new and effective approaches.

- Shifting the burden of preparing for and cleaning up after natural disasters to the states, counties, cities and homeowners?

- More federal subsidies.

If you answered ‘yes’ to any of these seven questions, please explain. If you favor another approach, please explain it.”

Neither campaign responded to my question by my deadline. I’ll keep you posted what I hear.

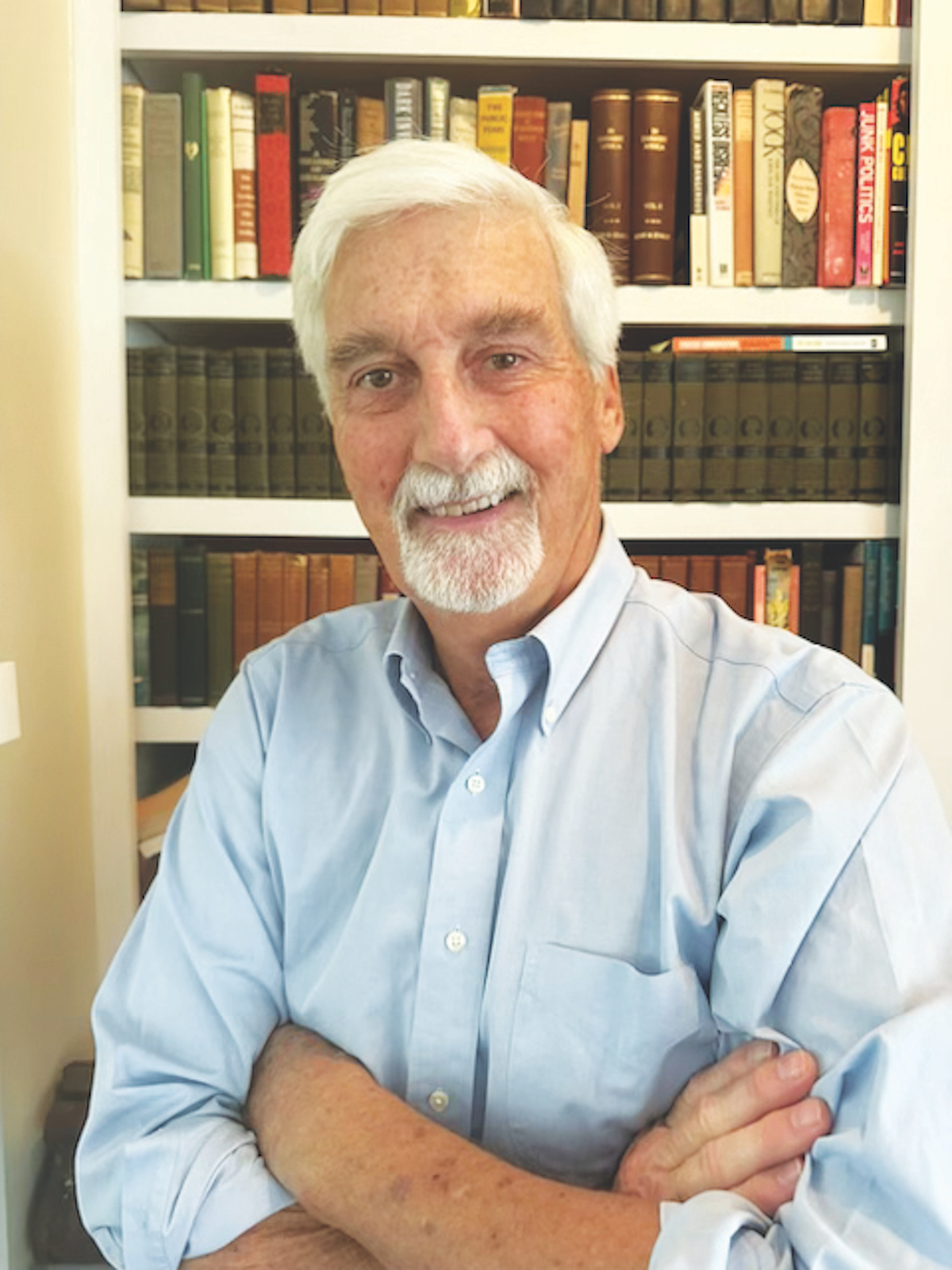

Bill Rauch was the mayor of Beaufort from 1999-2008. Email Bill at TheRauchReport@gmail.com.