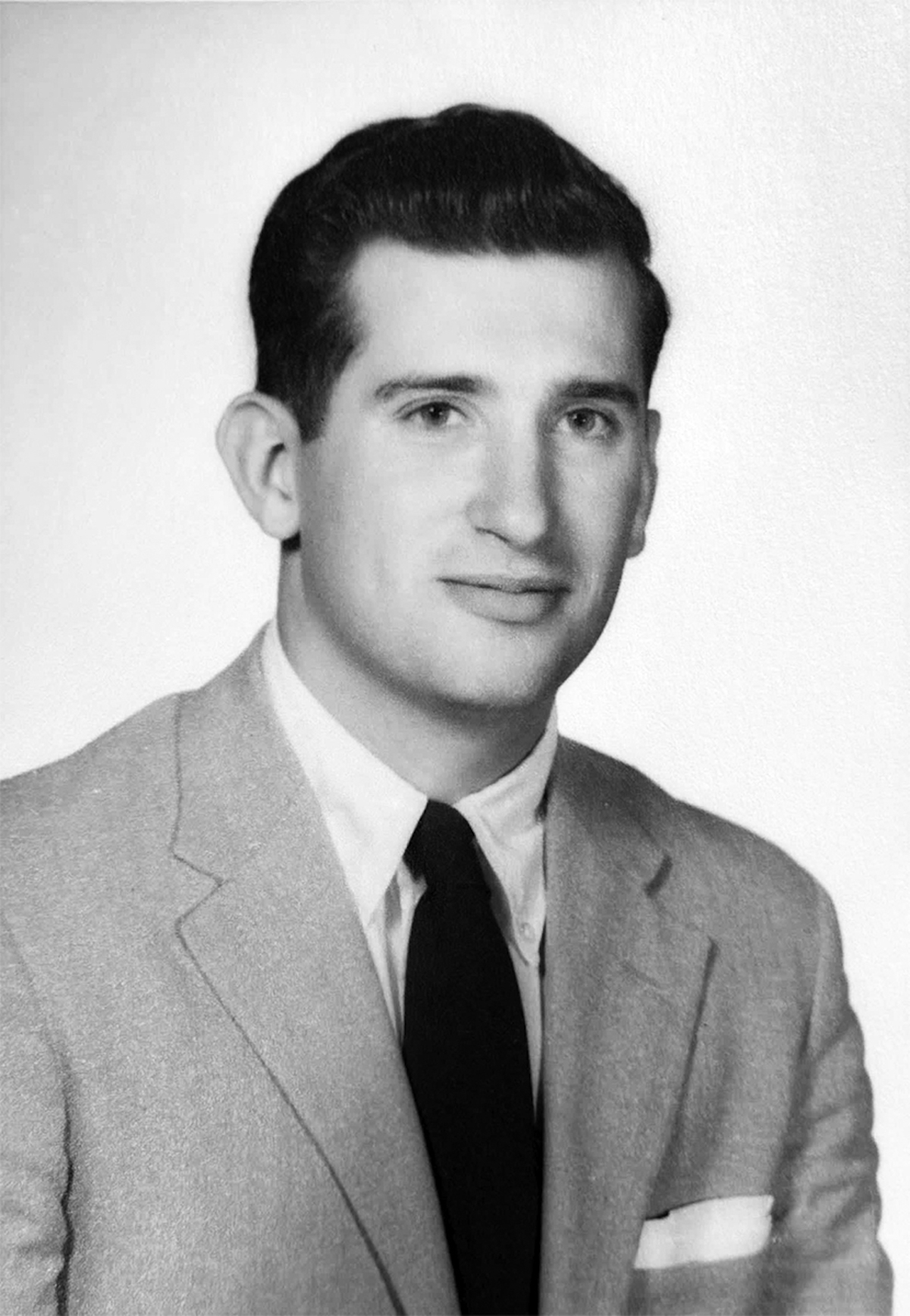

By Rep. Shannon Erickson, R-Beaufort

Fall is in the air and the Lowcountry of South Carolina is a wonderful place to be. The SC General Assembly is adjourned until January 2012 so no legislation is moving at this time, but there is still work ongoing.

I attended a National Teen Pregnancy Prevention meeting last month where South Carolina was applauded for our dual funded system which uses abstinence only and comprehensive education measures in all 46 counties with a collaboration of public and private entities to best use resources. We still have a long way to go, but our numbers are declining.

For the past several months, I have been serving on a House Tax Reform Task Force. We have heard testimony from various experts (Department of Revenue, SC Association of CPA’s, Fair Tax representatives, etc.) and are continuing these hearings through the month of October. Our goal is to make meaningful change in the tax structure in South Carolina for businesses and individuals. Your input is invaluable to me, so if there is a state tax situation that you’d like me to be aware of, please share.

Speaking of taxes, one group that watch-dogs legislation is the SC Policy Council. They released their “BEST & WORST” list (http://www.scpolicycouncil.com/pdf/bestworst2011.pdf) of 2011 filed bills from the SC House and Senate. I am proud to report that two of my bills made their “BEST” list and will work to see these bills moved through the legislative process.

• [Best] Prohibiting Fee/Fine Increases — H 3051: Passed House; referred to Senate Finance Committee. One reason government spending rises every year is because state agencies can administratively create and increase fines and fees. This bill would prohibit that practice, requiring instead that the General Assembly introduce fee/fine increases as a joint resolution subject to a recorded roll call vote.

• [Best] Reducing Sales Taxes and Eliminating Exemptions — H 4271: Referred to House Way & Means Committee. This bill would eliminate dozens of state sales tax exemptions, ranging from exemptions on newspapers to exemptions on wrapping paper. Exemptions on groceries, prescription medicine, durable medical equipment, and utility bills would remain in place. In return, H 4271 would reduce the general sales tax rate from 6 percent to 3.85 percent and the state accommodations tax from 7.0 percent to 4.5 percent. Based on previous analysis of a similar plan promoted by the Taxation Realignment Commission, the bill would likely result in increased tax revenue, suggesting the sales tax rate could be reduced by even more.

I am thankful to the Policy Council for shedding light on the legislative process and applaud their efforts in watch-dogging bills filed by both bodies.

Additionally on October 11, Governor Nikki Haley will be holding a Town Hall for the Lowcountry region at Bluffton High School (12 H.E. McCracken Circle) at 6:30 p.m. and I hope you will join me in attending.

I will attend a “Women in Government” convention in Charleston in mid-October which will host women legislators from around the U.S. I look forward to sharing information with them about our great state and hearing their state’s strengths and weaknesses.

In a recent USA Today, there is an article that showcases retirement systems and actually uses a component of the S.C. code as an example. I got many inquiries on this and did some digging. Yes, the article is correct and my research shows me that the issues cited happened in 2002 when a bill (not related to retirement) went through the House and Senate and a conference committee (three members of each body) and could not be agreed on. The House voted to allow that committee “free conference powers” which means the committee could add or delete anything that got them to an agreement on the bill. Quite frankly, that practice is dangerous and this is a perfect example of why. The retirement “addition” was put in during that process. What changed was that retirement could be drawn at age 70 and after 30 years of service — it turned into drawn at age 70 and/or after 30 years of service. This change was done basically with only a handful of people being aware of it. The House & Senate have committees studying the retirement system as a whole already and I have requested that this issue be added to their study. I am prepared to work to see this component removed.

As always, I enjoy being part of the Beaufort community and the wealth of diversity in our area. I was honored to attend the USC-BEAUFORT College of the Arts & Environment unveiling this past week, and commend Chancellor Jane Upshaw and USC President Harris Pastides for their support of this endeavor. Many thanks to local leaders Mayor Billy Keyserling, former Lt. Governor Brantley Harvey, and attorney Colden Battey for spearheading this effort. I was honored to serve on the committee and look forward to having our historic campus become vibrant once again.

Before that unveiling, Chancellor Upshaw advised me that efforts to change the name of our university are still ongoing. USC-BEAUFORT administration has signed a contract to spend $85,000 to do “market research” on the name change and public perception of USC-BEAUFORT. The funds are “private” dollars but at a time when ANY funding is difficult to come by, I maintain that spending any dollars on re-branding are irresponsible and unnecessary. In case you missed it, several months ago, the university touted “USC – Sea Islands” to replace USC-BEAUFORT. I did not agree then and I will not agree now to change our historically based name. To tell President Pastides and Dr. Upshaw that you want to keep our name and that no funds should be expended on re-branding, email jupshaw@uscb.edu or pastides@mailbox.sc.edu.